| HOME |

| NERVE |

| REVIEWS |

| ARCHIVE |

| EVENTS |

| LINKS |

| ABOUT US |

| CONTRIBUTORS |

| BACK ISSUES |

| CONTACT US |

Back to index of Nerve 22 - Summer 2013

The State of Welfare

Apart

from the changes to benefits, a whole raft of other changes to the Welfare

State will take effect this year. The government is dismantling entitlements

to social security and welfare support and attacking some of the poorest

people in our society, while many more people are being pushed into poverty.

Public services, welfare and benefits are not a gift from the government!

We all contribute to this system, whether in tax and national insurance,

or unpaid, in work bringing up children and caring for relatives.

Apart

from the changes to benefits, a whole raft of other changes to the Welfare

State will take effect this year. The government is dismantling entitlements

to social security and welfare support and attacking some of the poorest

people in our society, while many more people are being pushed into poverty.

Public services, welfare and benefits are not a gift from the government!

We all contribute to this system, whether in tax and national insurance,

or unpaid, in work bringing up children and caring for relatives.

BEDROOM TAX

In Liverpool just 23.5% of the city’s housing stock is made up of one-bedroom properties. Three-bedroom properties make up the overwhelming majority with 42.3%. So even if downsizing was an option there are not enough properties available.

The Tories think they have a ‘win-win’ situation by introducing the Bedroom Tax. If people can’t pay their rents then this causes a real problem for those who administer social housing. Many housing associations will go bust, throwing the cost of housing back on to cash strapped councils. If people accept the cut in benefit then the Tories will feel they have inflicted a defeat on poor people and the Welfare State. This is all part of the government’s privatisation agenda.

Why the Bedroom Tax is so unfair

In the 80s the Tory government introduced the right-to-buy, which saw the sell-off of hundreds of thousands of council houses. These homes were never replaced and very little social housing has been built over the last three decades, causing a massive shortage of affordable homes.

The same Tory government also abolished fair rents tribunals, which were there to protect private tenants from profiteering landlords.

It is these underlying causes that have resulted in the massive increase in the housing benefits bill that the government want to cut. When they carp on about paying out vast sums (capping benefits at £500 for a family, £350 for a single adult), they don’t say that most of this money goes to a landlord.

Some ideas on how to fight the bedroom tax

Set up a local campaign group! Contact Liverpool Against the Cuts (LATC) to help you organise a first local campaign meeting. LATC have been doing this all over Merseyside for the last few months. Advice groups are run by Liverpool Unite Community Branch in the Casa, Hope St, and ReClaim in the Peacock Pub, Westminster Rd, Kirkdale, both are on Friday afternoons.

Petition for no evictions Although Liverpool City Council have refused to call for a ‘No Evictions’ policy some other Merseyside councils have bent under a sustained campaign for this, so it’s worth pressing MPs, councillors and/or Housing Associations.

Block evictions by taking direct action During the Poll Tax revolt people stood together to physically stop bailiffs from evicting tenants. Build up a group of local residents that will become a human barrier to evictions. Set up a phone tree where people can quickly get in contact to bring out people when the bailiffs arrive.

LEGAL AID

The Legal Aid, Sentencing and Punishment of Offenders Act will come in on April 2013.

Citizens Advice Bureaux will lose 40% of their funding, and according to the government’s own assessment, around 600,000 people a year will lose access to advice and legal representation. Among areas for which it will no longer be available are: divorce, child custody, clinical negligence, welfare, employment, immigration, housing, debt, benefit and education. For instance people will not be able to appeal against an ATOS decision.

It’s no coincidence that just as all these cuts are coming in the

means to challenge them is being taken away.

They want to divide the so-called ‘Strivers’ and ‘Skivers’.

What can we do? First: Appeal! Appeal! Appeal! Challenge collectively! Stand Together!

DISABLED LIVING ALLOWANCE

From April 2013 DLA will be abolished and replaced with Personal Independent Payments (PIP). The change will only apply to working age adults.

Where people previously had to submit a very detailed form to apply for DLA, this will now be replaced with a medical test. The infamous Atos is preferred provider for the contracts to carry out the test in 2 out of 3 regions in the UK.

The government have said they wish to reduce costs by 20%. It is suggested

that this will mean 20% of those currently claiming will not qualify for

PIP when it is introduced, or alternatively (as the government has not

yet set the rates for PIP), it is possible they will reduce the amount

of the benefit. However the government has said it intends to focus support

on those in greatest need, and has plans to scrap the lower rate of the

care component.

DLA is most commonly used to contribute towards disabled people’s

non-luxury items like transport, heating/laundry and aids/equipment. Disabled

people say that the support is a lifeline.

From June 2013 all new claims will go straight onto PIP, from October 2013 DLA recipients with change of circumstances reassessed under PIP, and then full reassessment will be rolled out to all DLA claimants from January 2014.

UNIVERSAL CREDIT

The Universal Credit Scheme will provide a single streamlined benefit

that will “ensure work always pays”. As part of the ‘City

Deal’ Liverpool’s Mayor agreed to work with the government

on implementing the scheme. (see Nerve 20)

From October 2013 the following benefits will be replaced with a single

benefit:

Income Support, Income based Jobseeker’s Allowance, Housing Benefit,

Tax Credits, Income related Employment and Support Allowance.

Half of UK benefit spending goes on state pensions and only 3% on Job Seekers Allowance |

Initially all new claimants will go on to Universal Credit. It will normally be paid monthly in arrears directly to a single person in the household. All claimants will have to have a bank account or the equivalent e.g. a credit union account.

COUNCIL TAX BENEFIT

Council Tax Benefit (CTB) was replaced by Council Tax Support. In April 2013. Central government funding for CTB to Local Authorities (LAs) was cut by 10%. In Liverpool all working age households will pay at least 8.5% of their Council Tax Bill.

NHS

The struggle to hold back the privatisation of the NHS is raging across the country. Here in Liverpool the focus is on the management of GP surgeries turned over to the private sector and the use of PFI to build the new Royal Liverpool Hospital.

GP Surgeries

Most GPs operate as small independent businesses commissioned by the NHS to provide health care, however in Liverpool GPs and all practice staff in ten surgeries have been employed directly by the NHS. Two years ago Liverpool Primary Care Trust put the management of these surgeries out to tender and the PCT said there would be no consultation with patients, as services would not change. However, midway through the tendering process, they stopped and restarted it with different specifications, which leave patients with a poorer service. Patients were never consulted and the tender was awarded to SPP Health, a Wigan based company without a Medical Director. Staff were transferred to SSP on 1st April 2013.

Princes Park Health Centre is one of the ten surgeries and has been in the forefront of a campaign to get NHS commissioners (now called NHS England Merseyside Area Team), to repeat the tendering process and consult patients over any changes in services. Patients have come together through Keep Our NHS Public Merseyside to distribute 5,000 leaflets in English, Somali and Arabic in the area of the Health Centre. Nearly 400 people signed petitions, presented to Liverpool CCG (responsible for quality of primary care) and the Area Team who say they will address patients' concerns. Hopefully other health centres, now under SSP Health, will take similar action.

New Hospital

Recent publicity suggests that everything is nearly in place for the new Royal Liverpool University Hospital to be built using the thoroughly discredited PFI (Private Finance Initiative). This is a misrepresentation as the recently announced approval by the Treasury of the Draft Appointments Business Case, is only one of several stages in the approval process that must be completed before the actual contract to build the hospital is signed. Meanwhile in what appears to be a response to the public outcry, the Royal has received a grant from the Department of Health and this along with the possibility of a loan from European Investment Bank would reduce the proportion of the cost of the new hospital to be financed through PFI by nearly two thirds.

THE SOCIAL FUND

In April Community Care Grants, Crisis Loans were abolished, and the responsibility handed to Local Authorities (LAs). Budgeting Loans will still be available until the full introduction of Universal Credit in 2017.

Rich PickingsThere are 13,000 millionaires in Britain and Osborne has just cut the top rate of tax from 50p to 40p, giving them an average £97,000 tax cut, a total of £1.25b. Meanwhile, the new governor of the Bank of England is to be given the ‘benefit’ of a £5,000 housing allowance. |

There is no requirement for LAs to provide support, nor will the new Social Fund provision be ring-fenced, and there is no duty for councils to report how they have spent the money. Each authority can decide whether it sets up an assistance scheme, and what it will look like. In Liverpool this is to be called the 'Citizens Support Scheme'.

Charities are expecting that many councils will only offer 'in kind' schemes, and that no cash payments would be available. Rather LAs would set up arrangements with local voluntary organisations such as food banks to provide assistance. This is reflected in Liverpool in their 'Urgent Need Awards', usually paid in the form of a voucher sent by either email to your email account or by a message to your mobile. Vouchers can be cashed in one of the many Paypoint shops throughout the city.

A sure way to stigmatise people in need!

FIRE AND RESCUE

Merseyside Fire and Rescue service is being attacked, even though Cameron pledged that there would be NO cuts to the front line Fire & Rescue Service.

90 firefighter and 57 support staff posts to go over the next 2 years.

The proposal that £10 million be slashed from the service is to

be finalised by the Fire Authority meeting in June. This means cutting

42 engines down to 28. Merseyside, which is the busiest region in the

country, will be decimated. Examples of cuts are Toxteth and Old Swan,

which will lose 50% of their cover, so fire engines will be left idle,

as they cannot be fully staffed.

Les Skarrat from the Fire Brigades Union says:

"CUTS DO COST LIVES!" This is the message.

Most people that die in fires are from the poor and disabled and it is the budgets of the big cities that are being attacked. Cheshire and other shires are escaping these cuts (Osborne’s constituency is in Cheshire). This is a political choice: No Tory votes in these cities, so they don’t care. This is a class attack.

How do we fight this? The only people who can win this fight is us and communities collectively joining together ‘enough is enough’.”

CONTACTS:

Liverpool Against the Cuts, on Facebook

or email: liverpoolagainstthecuts@gmail.com

Keep Our NHS Public, c/o News from Nowhere,

96 Bold Street, Liverpool L1 4HY or email: KeepOurNHSPublicMerseyside@yahoo.com.

Unite the Union, www.unitetheunion.org/community,

Jack Jones House, Islington, Liverpool. 0151 203 1907

Thanks to the following for providing information for the above: Carol Laidlaw, Sam Semoff, Greg Dropkin, Aimi Molloy, Les Skarrat, Ruth Knox, Ian Seddon, Unite the Union, Unison.

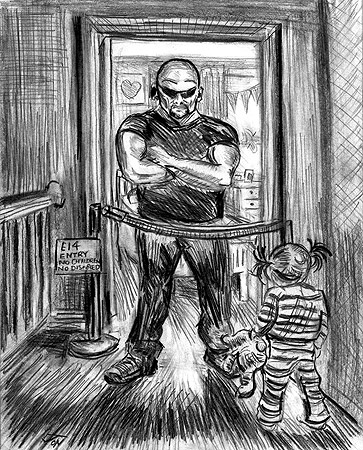

Image: ‘You’re Barred’ by John O’Neill